Are you a fan of L.L.Bean? Do you love outdoor gear and cozy clothes? If so, the L.L.Bean Mastercard might be just what you need.

This credit card is made for people who shop at L.L.Bean a lot. It gives you rewards when you buy things, both at L.L.Bean and other places too.

The L.L.Bean Mastercard is not just any old credit card. It’s special because it’s tied to the L.L.Bean store.

This means you get extra perks when you shop there. But don’t worry, you can use it anywhere Mastercard is accepted.

Activate.LLBean Mastercard.com

In this article, we’ll talk about everything you need to know about the L.L.Bean Mastercard.

We’ll cover how to log in, how to apply, and what benefits you can get. We’ll also look at how to use your rewards and manage your account.

If you’re thinking about getting this card, or if you already have one, this guide is for you. We’ll use simple words and explain things clearly.

By the end, you’ll know if this card is a good fit for you. Let’s dive in and learn all about the L.L.Bean Mastercard!

Let’s start with the basics. How do you get an L.L.Bean Mastercard? And if you already have one, how do you log in to your account? Here’s what you need to know:

Applying for the L.L.Bean Mastercard

Getting an L.L.Bean Mastercard is pretty easy. Here’s how you can do it:

- Go to the L.L.Bean website or the Barclays website

- Look for the “Apply Now” button

- Fill out the application form with your info

- Wait for a decision (it’s often very quick)

When you apply, you’ll need to share some information about yourself. This includes:

- Your name

- Address

- Income

- Social Security number

The bank will look at this info to decide if you can get the card. They’ll also check your credit score. If you have good credit, you’re more likely to be approved.

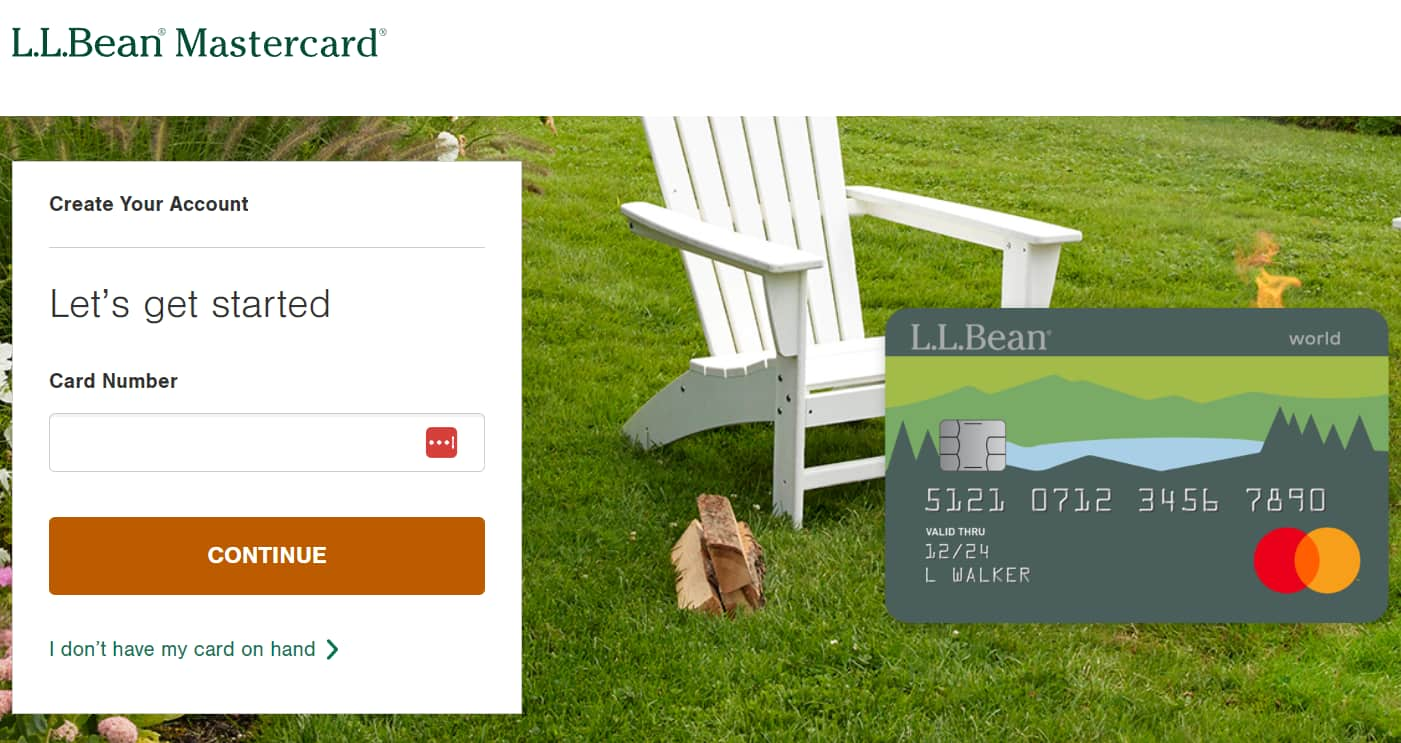

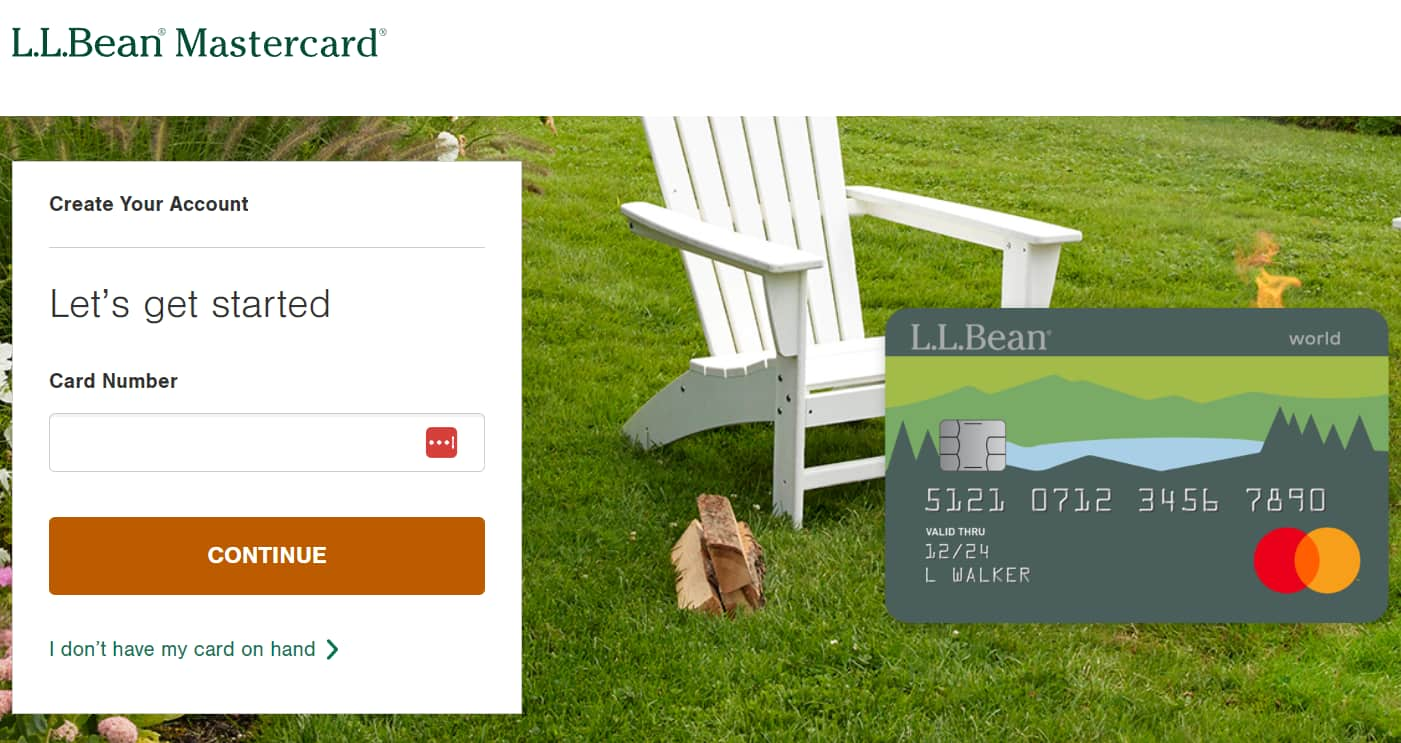

Activate.LLBean Mastercard.com Login

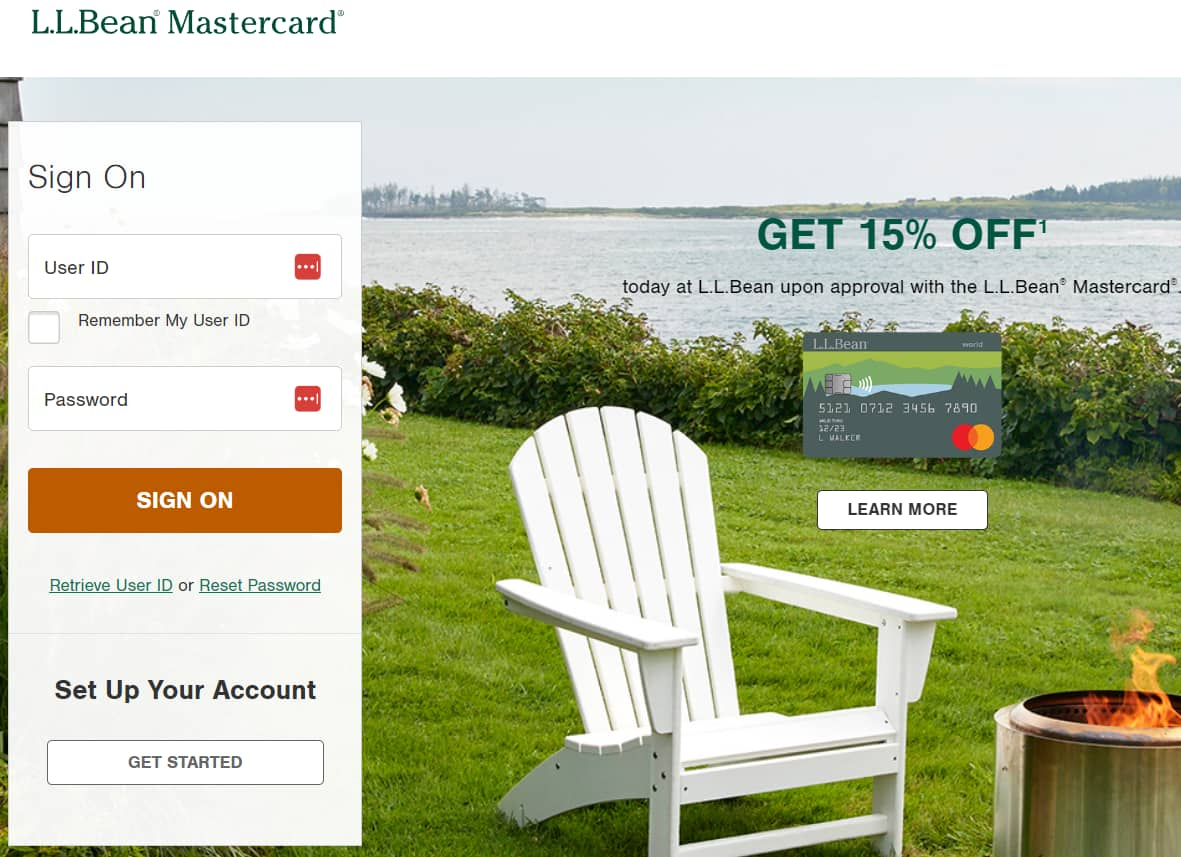

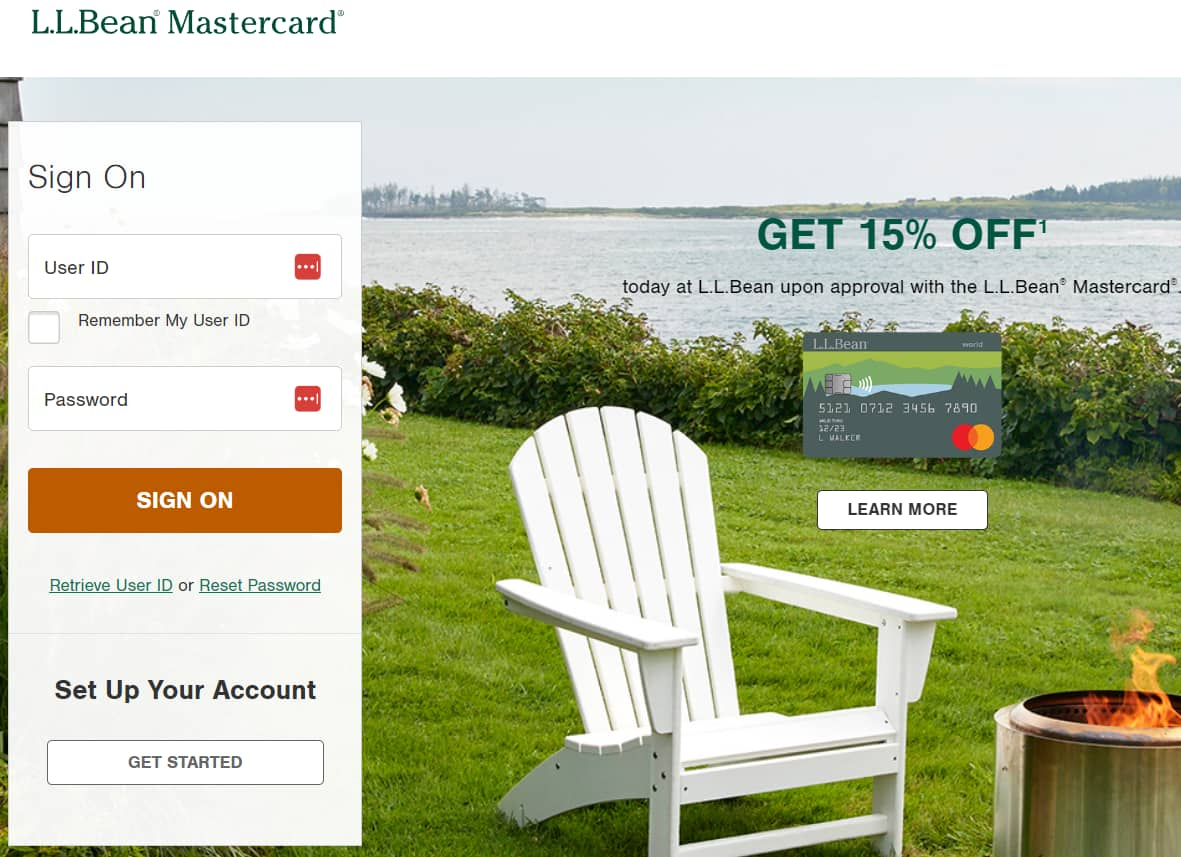

If you already have the card, you can manage it online. Here’s how to log in:

- Go to activate.llbeanmastercard.com

- Click on the “Log In” button

- Enter your username and password

- Click “Sign In”

If it’s your first time logging in, you’ll need to set up your account. Just follow the steps on the screen. It’s easy and only takes a few minutes.

Once you’re logged in, you can do lots of things:

- Check your balance

- See your transactions

- Pay your bill

- Set up alerts

- Update your info

Managing your account online is easy and can help you stay on top of your spending.

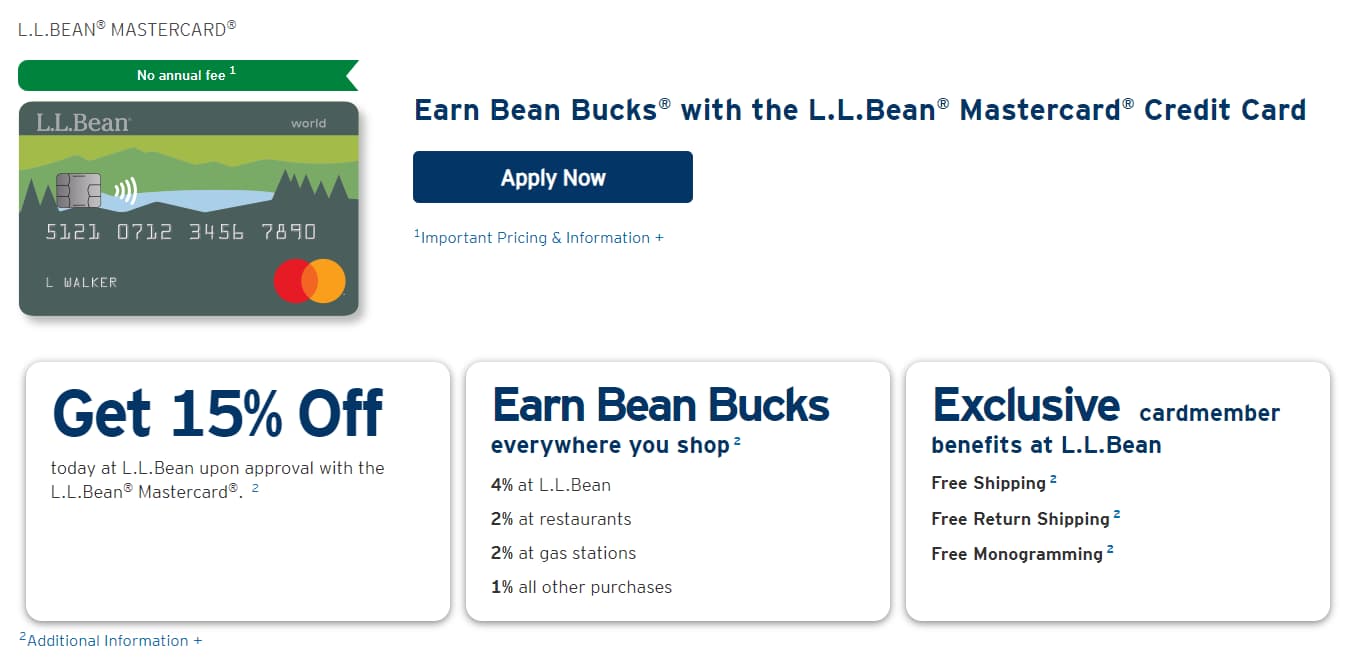

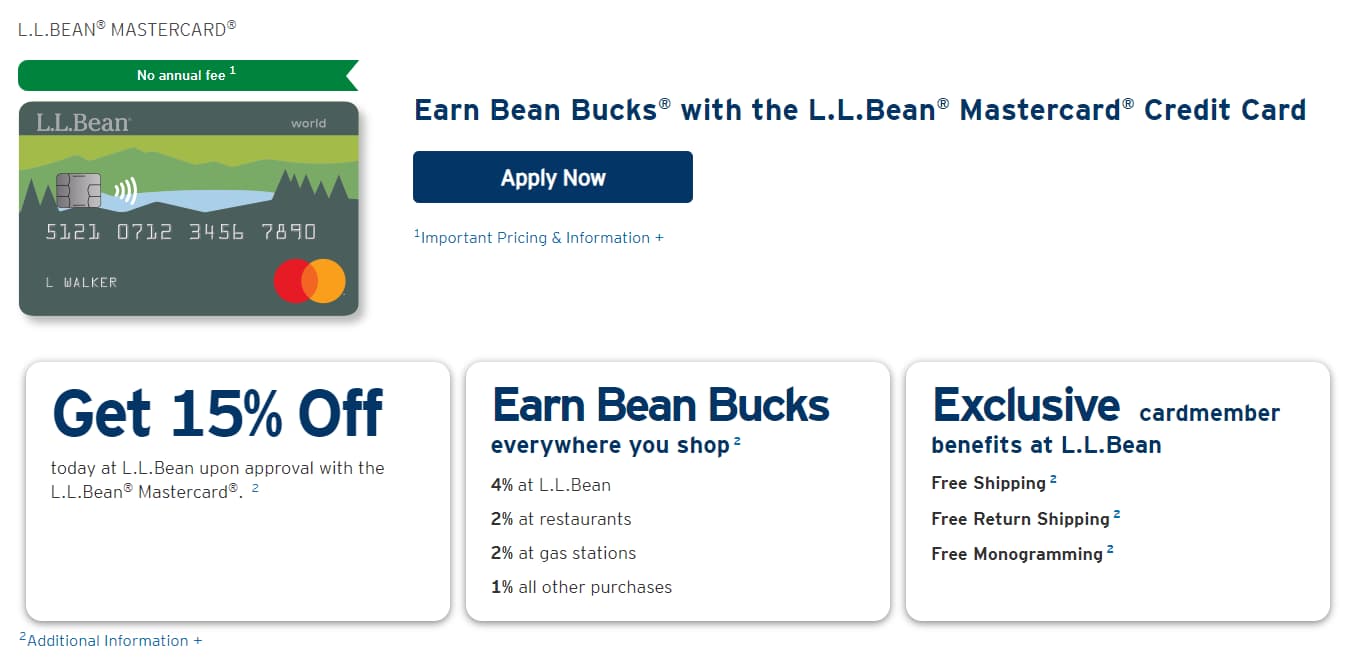

Advantage of L.L.Bean Mastercard

Now, let’s talk about why you might want to get this card. The L.L.Bean Mastercard has some cool perks, especially if you shop at L.L.Bean a lot.

Rewards Program

The biggest advantage of this card is its rewards program. Here’s how it works:

- You earn points on every purchase

- You get extra points when you shop at L.L.Bean

- These points can be used for future L.L.Bean purchases

This means the more you use your card, the more free stuff you can get from L.L.Bean. It’s like getting a discount on everything you buy.

Sign-Up Bonus

When you first get the card, you can earn a special bonus. This is called a sign-up bonus. To get it, you usually need to spend a certain amount in the first few months. It’s like a welcome gift from L.L.Bean.

Special Financing

Sometimes, the card offers special financing deals. This might include:

- No interest for a certain time on big purchases

- Lower interest rates for a while

These deals can help if you need to buy something expensive and want to pay it off over time.

No Annual Fee

Many credit cards charge you money each year just for having the card. This is called an annual fee. The L.L.Bean Mastercard often doesn’t have this fee. This means you can save money just by using this card instead of others.

Exclusive Discounts

Card members sometimes get special discounts at L.L.Bean. This could be:

- Early access to sales

- Special coupons

- Extra discounts on certain items

These extras can help you save even more money when you shop at L.L.Bean.

Here’s a quick summary of the advantages:

| Advantage |

Description |

| Rewards Program |

Earn points on all purchases, extra points at L.L.Bean |

| Sign-Up Bonus |

Get extra points when you first get the card |

| Special Financing |

Deals on interest for big purchases |

| No Annual Fee |

Save money by not paying a yearly fee |

| Exclusive Discounts |

Special sales and coupons for card members |

These perks make the L.L.Bean Mastercard a good choice for people who shop at L.L.Bean often. But even if you don’t, the no annual fee and rewards on all purchases can still be helpful.

L.L.Bean Mastercard Rewards & Benefits

Let’s dive deeper into the rewards and benefits of the L.L.Bean Mastercard. This is where the card shines, especially for L.L.Bean fans.

Earning Rewards

With this card, you earn rewards on everything you buy. But the amount you earn depends on where you shop:

- At L.L.Bean: You earn the most points here

- Everywhere else: You still earn points, but not as many

The exact number of points can change, but here’s a general idea:

| Where You Shop |

Points Earned |

| L.L.Bean |

4% back in rewards |

| Everywhere else |

1% back in rewards |

This means if you spend $100 at L.L.Bean, you might get $4 worth of rewards. If you spend $100 somewhere else, you’ll get $1 in rewards.

Types of Rewards

The rewards you earn come in two main forms:

- Points: These add up in your account

- Cash Back: This is like getting money back on your purchases

You can choose which type you prefer. Points are good if you want to save up for bigger L.L.Bean purchases. Cashback is nice if you want to use your rewards right away.

Extra Benefits

Beyond just earning points, the L.L.Bean Mastercard comes with some extra perks:

- Free Shipping: Sometimes, card members get free shipping on L.L.Bean orders

- Return Protection: If L.L.Bean won’t take something back, your card might help

- Extended Warranty: Your card might add extra time to product warranties

These benefits can save you money and give you peace of mind when shopping.

Special Promotions

L.L.Bean often runs special deals for card members. These might include:

- Double points on certain items

- Extra discounts during sales

- Early access to new products

Keep an eye out for these promotions. They can help you earn rewards faster or save more money.

Travel Benefits

Even though it’s a store card, the L.L.Bean Mastercard has some travel perks:

- No foreign transaction fees

- Travel accident insurance

- Auto rental collision damage waiver

These can be helpful if you like to travel, especially internationally.

Here’s a quick list of the main rewards and benefits:

- Earn points on all purchases

- Extra points at L.L.Bean

- Choice of points or cash back

- Free shipping offers

- Return protection

- Extended warranty

- Special promotions

- Travel benefits

Remember, the exact rewards and benefits can change. It’s always good to check the current offers before you apply or use your card.

L.L.Bean Mastercard Redemption Options

Once you’ve earned rewards with your L.L.Bean Mastercard, you’ll want to use them. This is called redeeming your rewards. Let’s look at how you can do this.

Using Rewards at L.L.Bean

The easiest way to use your rewards is at L.L.Bean. Here’s how it works:

- Shop at L.L.Bean (in-store or online)

- At checkout, choose to use your rewards

- Your total will go down based on how many rewards you use

It’s like having a gift card that you earned by shopping. You can use your rewards for anything L.L.Bean sells:

- Clothes

- Shoes

- Outdoor gear

- Home goods

Getting Gift Cards

Sometimes, you can turn your rewards into gift cards. These might be for:

- L.L.Bean

- Other stores

- Restaurants

Gift cards are good if you want to give your rewards as a present or use them somewhere else.

Travel Rewards

Some versions of the L.L.Bean Mastercard let you use rewards for travel. This could include:

- Flights

- Hotels

- Car rentals

If you like to travel, this can be a great way to use your rewards.

Cash Back

If you prefer, you might be able to get cashback. This means:

- Your rewards turn into real money

- The money goes back on your card as a credit

Cashback is nice because you can use it for anything, not just L.L.Bean stuff.

Here’s a table showing the main ways to use your rewards:

| Redemption Option |

How It Works |

| L.L.Bean Purchases |

Use rewards like a gift card at L.L.Bean |

| Gift Cards |

Turn rewards into gift cards for various stores |

| Travel |

Book flights, hotels, or car rentals with rewards |

| Cash Back |

Get money credited back to your card |

Tips for Redeeming Rewards

To get the most out of your rewards:

- Wait for sales at L.L.Bean to make your rewards go further

- Check for special redemption offers

- Use your rewards before they expire (if they do)

- Combine rewards with coupons for extra savings

Remember, the goal is to use your rewards in a way that’s best for you. Whether that’s new hiking boots, a gift for someone, or cash back, choose what makes you happiest.

L.L.Bean Mastercard Management

Managing your L.L.Bean Mastercard is easy, thanks to online tools. Let’s look at how you can keep track of your card and use it wisely.

Online Account Access

Your online account is your control center. Here’s what you can do:

- Check your balance

- See recent transactions

- Pay your bill

- Set up alerts

- Update your personal info

To get to your account:

- Go to activate.llbeanmastercard.com

- Click “Log In”

- Enter your username and password

If you’re new, you’ll need to set up your online account first. It’s easy and only takes a few minutes.

Checking Your Balance

Knowing how much you owe is important. To check your balance:

- Log in to your account

- Look for “Current Balance” on the main page

- This shows how much you owe right now

Remember, your balance changes as you make purchases and payments.

Viewing Transactions

To see what you’ve bought:

- Log in to your account

- Find the “Transactions” or “Activity” section

- You’ll see a list of everything you’ve bought

This helps you keep track of your spending and spot any weird charges.

Paying Your Bill

Paying on time is super important. Here’s how to pay online:

- Log in to your account

- Find the “Make a Payment” button

- Choose how much to pay and when

- Enter your bank info

- Submit your payment

You can also set up automatic payments so you never forget.

Setting Up Alerts

Alerts help you stay on top of your account. You can get alerts for:

- Due dates

- Payments made

- Large purchases

- Low balance warnings

To set up alerts:

- Log in to your account

- Look for “Alerts” or “Notifications”

- Choose which alerts you want

- Pick how you want to get them (email or text)

Updating Your Info

If you move or change your phone number, you need to tell the card company. Here’s how:

- Log in to your account

- Find “Personal Information” or “Profile”

- Make your changes

- Save the new info

Keeping your info up to date helps prevent problems with your account.

Mobile App

Many credit cards have mobile apps. If the L.L.Bean Mastercard has one, you can:

- Check your account on your phone

- Pay your bill anywhere

- Get instant alerts

Check if there’s an app for your phone. It can make managing your card even easier.

Here’s a quick list of what you can do to manage your card:

- Check your balance anytime

- See all your purchases

- Pay your bill online

- Set up helpful alerts

- Keep your info up to date

- Use a mobile app (if available)

Managing your card well helps you avoid fees and use your rewards smartly. It’s a big part of making the most of your L.L.Bean Mastercard.

L.L.Bean Mastercard Eligibility and Application

Thinking about getting the L.L.Bean Mastercard? Let’s talk about who can get it and how to apply.

Who Can Get the Card?

Not everyone can get this card. Here’s what you usually need:

- Be at least 18 years old

- Have a U.S. address

- Have a Social Security number

- Have a steady income

- Have a good credit score

Your credit score is really important. It tells the bank if you’re good with money. A higher score means you’re more likely to get the card.

What’s a Good Credit Score?

Credit scores range from 300 to 850. For the L.L.Bean Mastercard, you usually need:

This is considered a “good” credit score. If your score is lower, you might not get approved.

How to Check Your Credit Score?

Before you apply, it’s smart to know your credit score. Here’s how to check:

- Use a free credit score website

- Check with your bank (many offer free scores)

- Get a free credit report once a year

Knowing your score helps you decide if you should apply now or wait and improve your credit first.

Applying for the Card

Ready to apply? Here’s what to do:

- Go to the L.L.Bean website or the Barclays website

- Look for the “Apply Now” button

- Fill out the application form

- Submit your application

- Wait for a decision

The application will ask for info like:

- Your name

- Address

- Income

- Social Security number

Application Tips

To make applying easier:

- Have all your info ready before you start

- Double-check everything before you submit

- Apply when you’re not in a hurry

- Use a secure internet connection

What Happens After You Apply?

After you submit your application, a few things can happen:

- Instant Approval: You get the card right away

- Instant Denial: Your application is turned down

- Under Review: They need more time to decide

If you’re approved, you’ll get your card in the mail in about 7-10 days.

If You’re Not Approved

Don’t worry if you don’t get approved. You can:

- Ask why you were denied

- Work on improving your credit

- Try again later

Sometimes, waiting a few months and improving your credit can help you get approved next time.

Here’s a quick summary of the eligibility and application process:

| Step |

What to Do |

| Check Eligibility |

Make sure you meet the basic requirements |

| Know Your Credit Score |

Check your score before applying |

| Gather Information |

Get all your personal and financial info ready |

| Apply Online |

Fill out the application on the website |

| Wait for a Decision |

You might hear back right away or have to wait |

| If Approved |

Wait for your card to arrive in the mail |

| If Denied |

Find out why and work on improving your application |

Remember, getting a credit card is a big decision. Make sure you’re ready for the responsibility before you apply.